India is a global crypto hub with over 90 million users actively involved in trading, holding, or building around digital assets. As the market matures, traders keep looking beyond basic buying and selling, making it the leading country in crypto adoption. As of 2024, there was a 13% increase in worldwide crypto owners, mainly driven by the widespread adoption of Bitcoin and Ethereum ETFs, as well as the adoption of other altcoins.

Apart from traditional crypto trading, derivatives trading, or futures and options trading – offer more flexibility, better hedging tools, and new ways to profit, even in sideways markets. But, for Indian users, access to such products has often felt limited or complicated, especially without INR support.

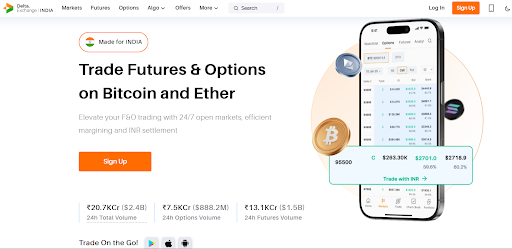

That’s where Delta Exchange steps in – one of the leading platforms has been gaining traction for making crypto F&O trading more accessible for Indian users. In this post, we’ll tell you all about how Delta Exchange works, what it offers, and why more traders are giving it a closer look.

A Quick Brief on Delta Exchange

In 2018, Delta Exchange started with a focus on making crypto derivatives trading more accessible to Indian users. Today, it’s one of the best crypto derivatives platforms offering a mix of instruments across Bitcoin, Ethereum, Solana, and several other altcoins, giving you a fair amount of flexibility in crypto F&O trading.

Source | Traders’ go-to platform for crypto F&O trading

What stands out is how the platform balances technical features with user experience. For easier navigation and to trade on the go, Delta has also released an Android- and iOS-compatible app, making it easy to navigate the market and access tools built for serious trading.

With compliance from India’s Financial Intelligence Unit (FIU) and a strong push for secure operations, the platform has gained considerable credibility. Its growing volume, reportedly crossing $4 billion in daily trades, clearly indicates a growing base of users looking for more control in their F&O trading strategies.

Why Traders Prefer Delta Exchange for Crypto F&O Trading

Delta has carved a strong niche in crypto F&O trading by offering a regulated platform and trader-first approach.

Source | BTC options trading on Delta Exchange

Here’s what sets it apart from other exchanges in the market:

- Futures and options contracts on major cryptocurrencies

You can trade European-style call and put options on BTC and ETH with multiple expiries – daily, weekly, or monthly. If you’re into longer positions, future contracts on coins like BTC, ETH, and SOL offer continuous exposure without expiry dates.

- INR-based transactions

Unlike most other crypto platforms, the Delta Exchange app lets you trade directly in INR. This eliminates conversion delays and keeps transaction costs lower, which is a big win for frequent traders.

- Strategy builder and basket orders

Delta’s strategy builder simplifies multi-leg crypto F&O trading. You can pre-set trades, automate your entries, and use basket orders to place multiple trades in one go – it’s a good way to save on margin and execute strategies faster.

- Built-in trading bots

For those who prefer automation, Delta offers automated trading bots that help you execute algorithmic strategies without constant screen time. They’re useful for catching quick moves or sticking to a set strategy.

- Demo trading mode

If you’re testing new strategies or learning how crypto F&O trading works, the demo account provides a risk-free environment with live market pricing – ideal for hands-on practice.

- Payoff graphs

Before placing trades like straddles, strangles, or ratio spreads, you can view payoff graphs to analyse potential outcomes. It gives a clearer picture of your risk-reward profile, breakeven points, potential profit and loss, and helps you fine-tune your strategy before finalising trades.

- Round-the-clock support

If you feel stuck, you can always raise a ticket for your query and seek timely assistance from the team. Delta operates efficiently 24/7, even during high-volume phases.

Getting Started with Delta Exchange

Starting your crypto F&O trading journey on Delta is quick and simple. Here’s how to go about it:

- Head to www.delta.exchange and click on sign up.

- Create your account and complete KYC by adding personal and bank details correctly.

- Deposit INR directly using the payment method of your choice.

- Explore the crypto derivatives – futures and options – contracts, which operate 24/7.

- Choose from BTC, ETH, SOL, and other altcoins to start trading without needing to own the assets.

- Withdraw funds anytime by adding proper account details.

You can also get the Delta Exchange app from the App Store (iOS) or the Play Store (Android).

Source | Download the Delta Exchange app and trade from anywhere, anytime

The Bottomline

Crypto trading platform like Delta Exchange are becoming a key part in how you manage exposure, test strategies, and try to boost your returns in a volatile market. Whether it’s the option to hedge during uncertain phases or trade small lots like BTC (starting ~₹5,000) and ETH (~₹2,500), Delta caters to all kinds of traders.

Features like 100x leverage, risk management tools, and live margin monitoring make it easier for you to stay in control without needing massive capital. Plus, with weekly expiries, payoff previews, and 24/7 market access, you’re no longer limited by traditional market hours.

As you look for more structured ways to participate in crypto derivatives trading, Delta Exchange might be a good place to start.

For more information, visit the website or join our community on X for all the latest updates.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. This article is for informational purposes only. Kindly do your own research and consult experts before making any investments in crypto.