Token launches in 2026 are increasingly being evaluated not by short-term narratives, but by whether real revenue and sustained usage exist behind the token.

$HEALTH went live on LBank and surged 220% from its $0.15 listing price over the weekend, highlighting growing interest in ownership models tied to real products and everyday consumer demand. This structure aligns closely with what many analysts now view as the best crypto token 2026, driven by real-world usage rather than speculative narratives. It’s also trading on Raydium as we speak.

As liquidity-driven launches lose effectiveness, the market is beginning to reward tokens that are directly connected to operating businesses with measurable performance.

The Foundation: Revenue-Backed Token Demand

The strongest token launches in 2026 are tied to real business execution, not artificial liquidity or emissions. When revenue exists, token demand forms naturally around usage rather than speculation.

A clear example is Hyperliquid, which reached approximately $1.36 billion in TVL only after proving product-market fit through trading volume, fees, and active users. In this case, revenue came first, and token demand followed.

This pattern matters because tokens backed by live revenue benefit from organic demand loops, measurable performance, and repeat usage. Price behavior increasingly reflects execution and cash flow rather than short-lived attention cycles.

The same logic applies to tokenized consumer brands, where real products are sold and consumed daily.

Why Traditional Ownership Breaks Down

Consumer brands grow through repeat purchases, yet ownership remains concentrated among insiders, funds, and late-stage investors. While consumers generate revenue, they rarely participate in long-term value creation.

In traditional ownership models:

● Equity access arrives late, often after most growth is captured

● Loyalty programs reward spending, not long-term contribution

● Consumers help scale revenue without economic alignment

As consumer brands scale globally, this structural mismatch becomes harder to justify.

$HEALTH Tokenomics at a Glance

The $HEALTH token is a Solana-based utility token with a fixed supply of 10 billion, designed for long-term alignment rather than short-term liquidity extraction.

Allocation is structured to support sustainable growth:

● Community: 20% for gradual engagement and rewards

● Team and advisors: 18% with a 12-month cliff and long-term vesting

● Token sale: 18% with partial TGE unlock and linear vesting

● Strategic partners and enterprise: 12% milestone-based

● Liquidity and market stability: 11% combined

● Treasury, operations, governance, and marketing: remaining balance

This structure prioritizes controlled unlocks, alignment, and price stability over fast emissions.

$HEALTH Token Utility and Produce-to-Earn Model

$HEALTH utility is designed to align participation with real production activity, not governance control or speculative yield. Ownership reflects economic alignment with the brand’s output rather than decision-making authority.

Core utilities include:

● Produce-to-Earn participation, where holders retain $HEALTH during active production cycles

● Quarterly value distribution, with 15% distributed every three months, aligned with completed production cycles

● Real-economy exposure, tied to manufacturing and sales execution rather than staking rewards

There is no DAO and no governance voting. Utility is driven by production, distribution, and real-world performance.

Wrap-Up

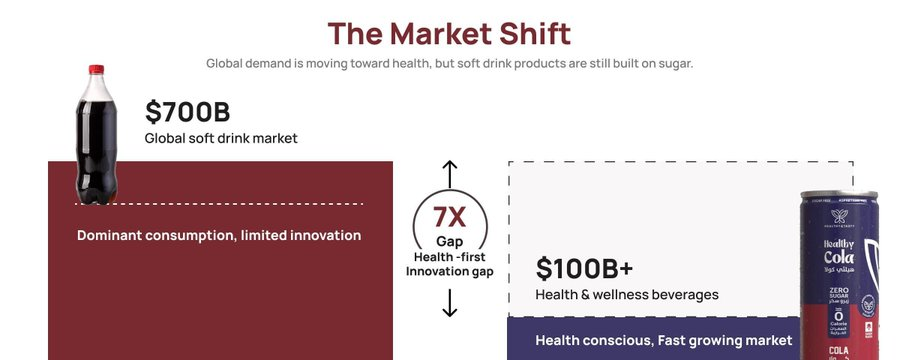

Healthy Cola products are already being consumed daily via Nonn and Talabat, while health-first cola adoption still represents a ~7× gap compared to traditional sugar-based alternatives.

This gap reflects a structural shift in consumer demand toward zero-sugar, clean-label beverages and revenue-backed consumer brands, positioning $HEALTH, supported by real-world consumption at Healthy Cola, among strong contenders in this category.

$HEALTH is now live on LBank, offering early exposure to this transition as real-world consumption and distribution continue to scale. Readers can also join the official Telegram community to follow product expansion and ecosystem updates.